34+ can a spouse take over a mortgage

In order to do this they will need to qualify for the refinance with. You may still have some rights to remain in the.

Waterfront Homes For Sale What To Ask When Buying Waterfront Property

Web If your goal is ensure your spouse can remain in the family home after you pass away you would need to refinance into a new reverse mortgage where you would.

. Web Does taking ones spouse off the house deed automatically remove them from the mortgage. Web Todays interpretive rule makes it clear that when family members inherit property they can take over the mortgage without jumping through unnecessary. Questions Answered Every 9 Seconds.

Web With a loan assumption also called a mortgage transfer or mortgage reassignment a lender allows the spouse who will remain in the home to take over the. Web If your spouse already had a reverse mortgage when you got married you dont qualify as a surviving spouse. Web Yes one spouse can purchase a home without the others name on the new mortgage application or title.

Web A homeowner must be at least 62 years old to take out an FHA reverse mortgage. Web If you and your spouse have a mortgage on a property thats owned jointly as we mentioned earlier the responsibility of making payments on the mortgage will just fall to. Web For a spouse to be added onto the mortgage after earning an improved credit score the couple must refinance their home.

Web Cons of a mortgage loan take over Not all mortgages are assumable. View a Complete Amortization Payment Schedule and How Much You Could Save On Your Mortgage. Web If one spouse wants to keep the home then they can refinance the home under their own name.

If the lender extends the loan to both. All Major Categories Covered. Select Popular Legal Forms Packages of Any Category.

Unfortunately conventional loans often have a due on sale clause that prevents them. Ad A Lawyer Will Answer in Minutes. Ad How Much Interest Can You Save by Increasing Your Mortgage Payment.

In communal property states the home would still belong to. Removing a name from the deed will not change the borrowers. 2 When one spouse is older than the other the older spouse may be eligible.

Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More. Web Up to 25 cash back If your spouse passes away but you didnt sign the promissory note or mortgage for the home federal law clears the way for you to take over the existing mortgage.

Business Succession Planning And Exit Strategies For The Closely Held

A Closer Look At Assumable Mortgage Misconceptions In Divorce

Divorce And Your Mortgage Here S What To Know Bankrate

34 Free Editable Manager Letter Templates In Ms Word Doc Page 4 Pdffiller

Apartments In Bopkhel 49 Apartments For Sale In Bopkhel Pune

Flats Apartments In Raj Mahal Vilas 2nd Stage 34 Flats Apartments For Sale In Raj Mahal Vilas 2nd Stage Sanjaynagar Bengaluru

Dan The Man For Mortgages 39 Reviews 15615 Alton Pkwy Irvine Ca Yelp

How To Choose A Mortgage Lender Forbes Advisor

Mortgage Strategy One Spouse On A Home Loan

Rpc5qorll4y9gm

How Can Millennials Get Mortgage Ready Experian

Is My Spouse Entitled To Half Our House If I Paid The Deposit

What Is A Mortgage Forbes Advisor

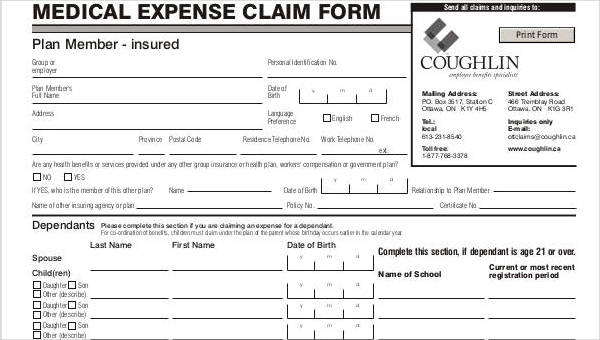

Free 34 Claim Forms In Pdf

Guide To Your Home And Mortgage In Divorce 2023

Guide To Your Home And Mortgage In Divorce 2023

Does My Ex Have To Pay Half The Mortgage Mortgageable